Incentives and Rebates

Available Incentives

& Rebates

At EVunited, we believe your adoption of Electric Vehicle Charging should include an "opportunistic strategy", as to take advantage of available rebates, grants and other incentives that may be available to you and your organization. We encourage our clients to take advantage of these programs, prior to the funds being depleted. Our team stays up to date on all active rebate and grant programs (federal and local), including tax incentives that may be available. Our specialists offer complimentary advisory and assistance with the application process, as to make the adoption of EV charging seamless and affordable.

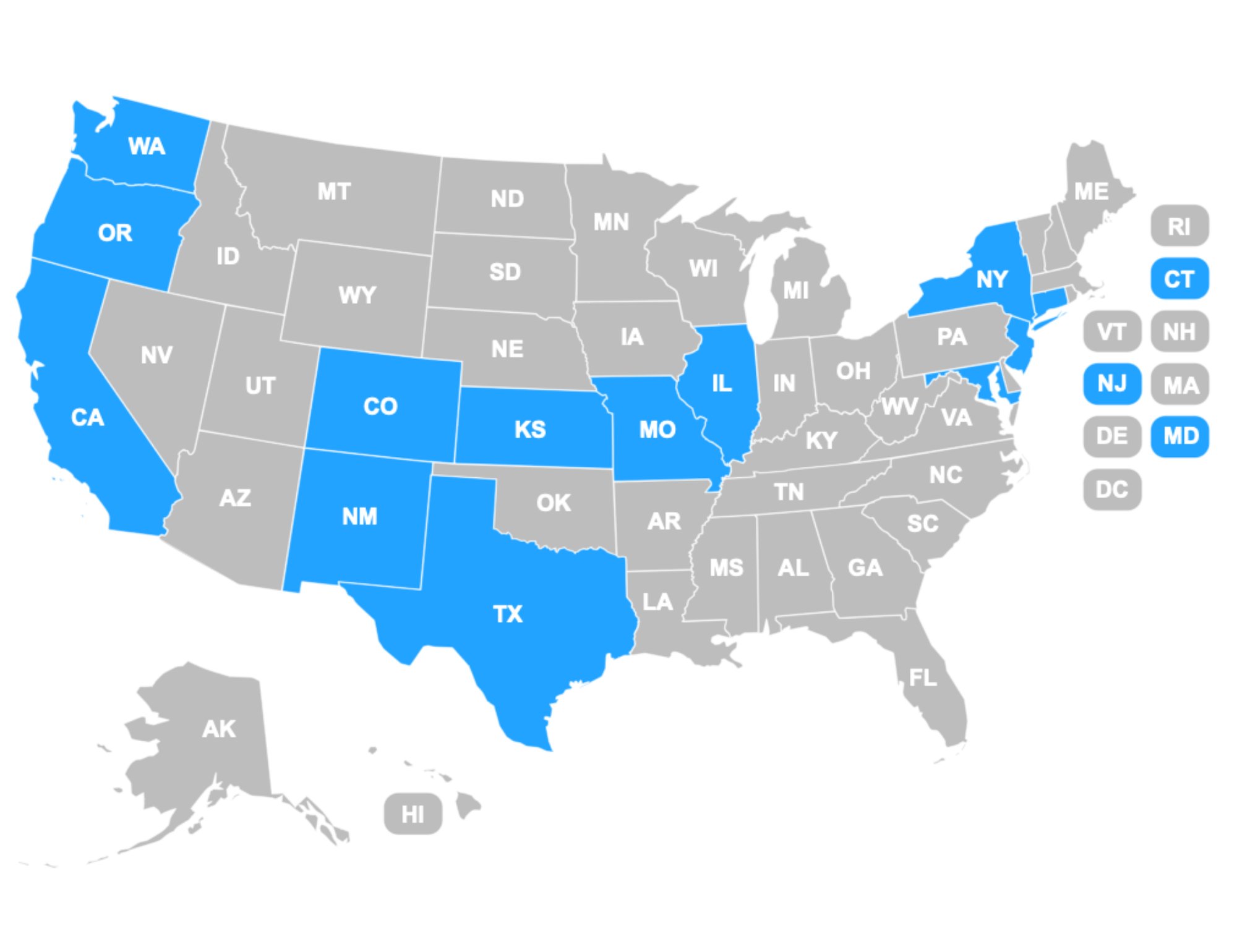

Incentives Available (by state)

Several states have significant funding available to support the adoption and deployment of EV Charging station, including Fast Chargers.

These rebates can significantly lower the upfront cost of purchasing and installing electric vehicle charging stations. To find out what's available for you, contact EVunited.

National Electric Vehicle Infrastructure (NEVI) Formula Program

The NEVI Program provides $5 billion to states, specifically for installing fast charging stations for electric vehicles along major transportation routes across the country. The program provides funding for up to 80% of eligible project costs. In addition to the Federal Highway Administration, each state can also set its own NEVI requirements. We have highlighted the states above that have active or upcoming rounds of available NEVI funding.

Alternative Fuel Infrastructure Tax Credit (Section 30C)

A federal tax credit is available to qualified businesses, non-profits, and municipalities for the installation of electric vehicle charging stations. The 30C tax credit covers up to 30% of the project costs, up to $100,000 per item, provided the equipment is installed in a location that meets specific requirements. Please consult with your tax advisor to determine if you your company is eligible.

NOTE: The Alternative Fuel Infrastructure Tax Credit (Section 30C) will expire for property not placed in service by June 30th, 2026. This expiration date was established by the "One Big Beautiful Bill Act," enacted in July 2025, which shortened the original expiration date of December 31, 2032, set by the Inflation Reduction Act of 2022.

Eligibility Map (locator): View Map